- support@difintpaytech.com

Difint Paytech Private Limited - 2nd Floor, Minarch Tower, Plot no. 4, Sector - 44, Gurgaon, PIN -122003

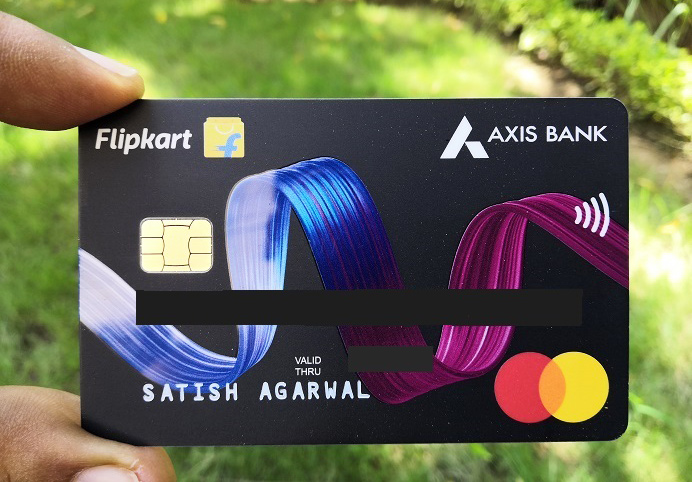

Credit Card

Credit Cards are small sized plastic cards that can make life very simple. These cards allow you to purchase goods and services on credit, the money for which you can return at the end of every month. You can choose to pay the full amount of credit that you have borrowed from your credit card issuer or a minimum fixed amount every month. In case you pay only the minimum amount, remember that you will be charged an interest on your outstanding balance. There is a credit limit set for you by your card provider. Mentioned below are the credit cards offered by us:

Axis My Zone CC.

- Axis Flipkart CC.

- SBI Simply Click CC.

- Indusind Bank CC.

- AU Bank CC.

- IDFC Bank CC.

- RBL Babk CC.

- Bajaj Finserv.

DMT (Domestic Money Transfer):

With the help of the innovative Direct Money Transfer (DMT) service, you can send money quickly to any Indian bank account holder.

Our Key features

Instant & prompt transfer to any bank in India

- Reliable and convenient transfer to any bank account in India

- Direct credit to the beneficiary account via IMPS-based service

- Enjoy fast services on this reliable medium with a nominal fee.

- Quick and fast transfers even on bank holidays

AEPS (Aadhar Enable Payment Services) for cash withdrawal

Aadhaar Enabled Payment System (AEPS) is a payment service that allows a bank customer to use Aadhaar as his/her identity to access his/her Aadhaar enabled bank account and perform basic banking transactions like balance enquiry, cash withdrawal, remittances through a Business Correspondent

Key Features of AePS

Easy to use.

- Secure payment method.

- Accessible and compatible across all banks.

- With Aadhaar Authentication, AePS permits payments of government schemes like Jan Dhan Yojana, social security pension, etc., or any state or national government organizations.

- All bank account holders would be able to access their accounts using Aadhaar authentication under this system.

BBPS (Bharat Bill Payment System)

Bharat Bill Payment System is an integrated bill payment system in India offering interoperable and accessible bill payment service to customers through a network of agents of registered member as Agent Institutions, enabling multiple payment modes, and providing instant confirmation of payment. We provide all kind of utility bill payments (Electricity, water, gas, etc.), mobile recharge, etc. through our web portal & application, this is most reliable and fast service works 24*7.

Loan:

Difint has partnered with multiple NBFCs through which we provide multiple loan services: Instant Personal Loan, Business Loan for small shopkeepers, Car Loan, Two Wheeler, Home Loan, Other Loans.

Loan Referral Services: Difint has partnered with multiple NBFC to provide its retail network & Customer credit facility at attractive interest rate.

Credit facilities offered are as below:

For Difint Customers:

- Personal Loan: In this segment we have a very clear vision that we have to provide instant small ticket size loan to migrant / local factory workers to fulfil their needs of small funds requirements for any kind incidental needs like medical emergency / grocery purchase / school fees, etc. Here a personal loan is an unsecured loan for which you don't have to provide any collateral to receive the funds. Availing personal loan via Difint partner NBFC is easy – you can apply online and can use the money to meet almost any expense

- Business Loan: Difint customers can avail business loan at attractive rate of interest & it’s Difint vision to be a helping hand for small shopkeepers for their any financial / business needs.

For Difint retail network:

- Business Loan: A business loan is an unsecured form of credit designed to cover various expenditures in a business.

-

Working Capital Loan: Working capital loans are short-term loans for maintaining day-to-day operations.

Difint retailers can apply for a business loan or working capital loan with Difint’s partner NBFC. Once you fulfill the required eligibility criteria, you can fill up the online business loan application to process your application.

*Note: Difint acts as a referrer to the partner NBFC & on non-risk participation basis. The NBFC is responsible to provide credit facility as per their credit & underwriting policy. The partner NBFC at its sole discretion can approve / reject the loan application.

Instant Bank Account opening:

Difint provides instant bank account opening through our partner Banks. We offer CSP of multiple Banks which enable our channel partners to open bank account instantly and can earn handsome money.

Bank account verification

Our Account Verification process simple & easy way to verify bank account holder and details. Account verification ensure that your money goes exactly where it is supposed to.

Real-time Pan Verification

We provide an NSDL-powered Pan verification process to validate your customers, employees, and merchants. Our easy-to-use process has made PAN fraud a thing of the past.